Budget 2025-26: Big Changes in Salary Tax – Full Slab Breakdown Inside!

Major Salary Tax Changes, Pension Hike, and BISP Budget Boost in Federal Budget

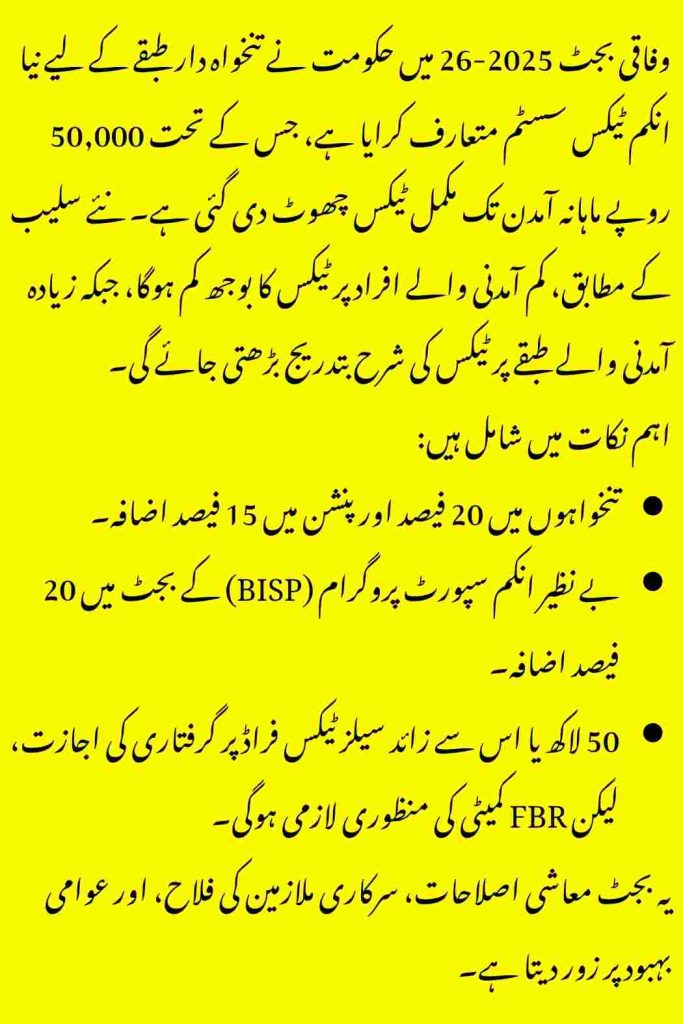

ISLAMABAD – The Government of Pakistan has officially introduced new income tax slabs for salaried individuals in the fiscal year 2025-26, following the approval of the federal budget by the National Assembly.

The revised tax structure will come into effect from July 1, 2025, and aims to bring progressive reforms in taxation while easing the burden on low-income earners.

New Income Tax Slabs for Salaried Peoples

Under the new policy, monthly income up to Rs50,000 (or Rs600,000 annually) will be fully exempted from income tax. This move is expected to benefit a large portion of the salaried class.

| Slab | Annual Income Range (PKR) | Fixed Tax (PKR) | Rate on Excess Amount |

|---|---|---|---|

| 1 | Up to 600,000 | 0 | 0% |

| 2 | 600,001 – 1,200,000 | 0 | 1% |

| 3 | 1,200,001 – 2,200,000 | 6,000 | 11% on amount above 1.2 million |

| 4 | 2,200,001 – 3,200,000 | 116,000 | 23% on amount above 2.2 million |

| 5 | 3,200,001 – 4,100,000 | 346,000 | 30% on amount above 3.2 million |

| 6 | Above 4,100,000 | 616,000 | 35% on amount above 4.1 million |

Example: If a person earns Rs100,000 per month (Rs1.2 million per year), their income tax will now be just 1%, or Rs1,000 per month.

Other Major Highlights of Budget 2025-26

- The total federal budget for 2025-26 stands at Rs17.573 trillion, presented by Finance Minister Muhammad Aurangzeb.

- A 20% increase in salaries has been approved by the Punjab Auqaf Department Board, while pensions will see a 15% hike, offering relief to both active employees and retirees.

- The BISP budget sees an unprecedented 20% rise for the upcoming fiscal year. This was a key demand from the Pakistan People’s Party (PPP).

Strict Measures Against Tax Fraud

To curb tax fraud and corruption:

- Individuals involved in sales tax fraud involving Rs50 million or more can now face arrest.

- Crimes like issuing fake invoices, tampering with records, destroying documents, or attempting to flee the country will lead to legal action.

- However, arrests must first be approved by a Federal Board of Revenue (FBR) committee, and detainees must be produced before a magistrate within 24 hours.

Conclusion

Revised tax slabs ease the burden on low earners, tighten checks on evasion. With increased allocations for public welfare programs like BISP and pay raises for government employees, the 2025-26 budget focuses on both economic reform and public support.