How Much Tax Are Pakistanis Paying Per Liter of Petrol and Diesel?

Islamabad: The latest official data has revealed the detailed breakdown of taxes, duties, and margins included in the prices of petroleum products in Pakistan, shedding light on how much the public is paying beyond the base fuel cost.

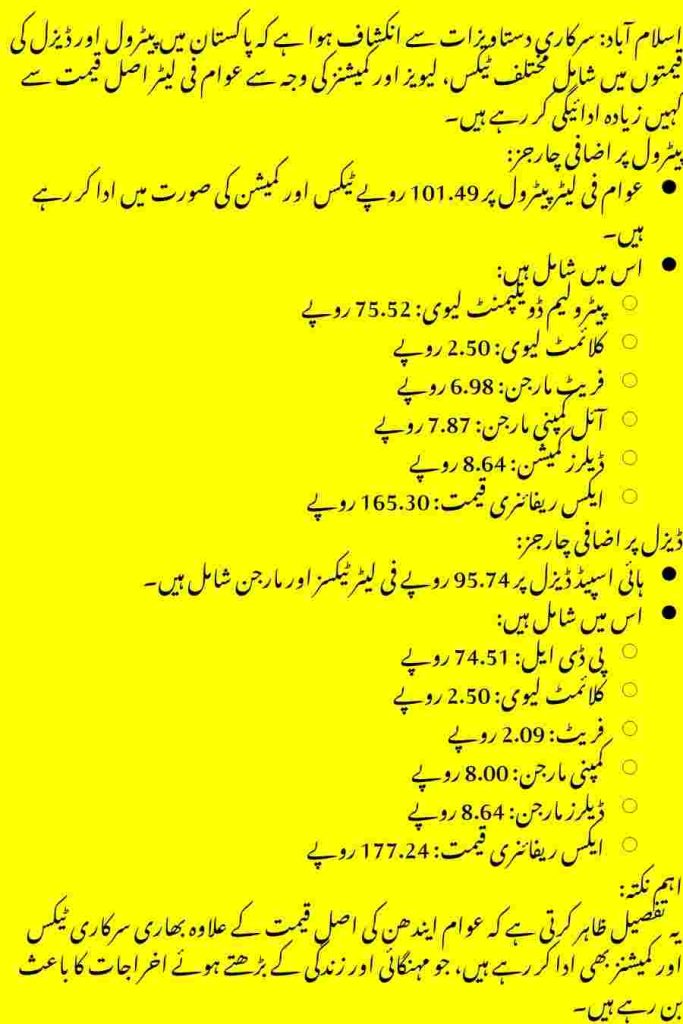

Petrol – Over Rs. 101 in Taxes and Charges

According to government documents, consumers are currently paying a total of Rs. 101.49 per liter in various taxes, levies, and margins on petrol.

Here’s how the amount breaks down:

- Petroleum Development Levy (PDL): Rs. 75.52 per liter

- Climate Levy: Rs. 2.50 per liter (implemented from July 1, 2025)

- Freight Margin: Rs. 6.98 per liter

- Oil Companies’ Margin: Rs. 7.87 per liter

- Dealers’ Commission: Rs. 8.64 per liter

- Ex-refinery Price: Rs. 165.30 per liter

These components are added together to determine the final retail price of petrol sold to consumers.

Diesel – Tax Burden Reaches Rs. 95.74 Per Liter

High-speed diesel (HSD) carries a slightly lower but still significant load of taxes and margins, totaling Rs. 95.74 per liter.

Breakdown of charges on diesel:

- Petroleum Development Levy (PDL): Rs. 74.51 per liter

- Climate Levy: Rs. 2.50 per liter

- Freight Charges: Rs. 2.09 per liter

- Oil Companies’ Margin: Rs. 8.00 per liter

- Dealers’ Margin: Rs. 8.64 per liter

- Ex-refinery Price: Rs. 177.24 per liter

Why This Matters

These figures highlight how a significant portion of the price consumers pay for petrol and diesel goes toward government-imposed levies and margins for oil companies and dealers, not just the cost of the fuel itself.

Many citizens and analysts argue that the burden of such heavy taxation on fuel is ultimately passed on to the public, contributing to inflation and increasing the cost of living .