Massive Oil and Gas Reserves Discovered in Pakistan’s Waters: A Potential Game-Changer

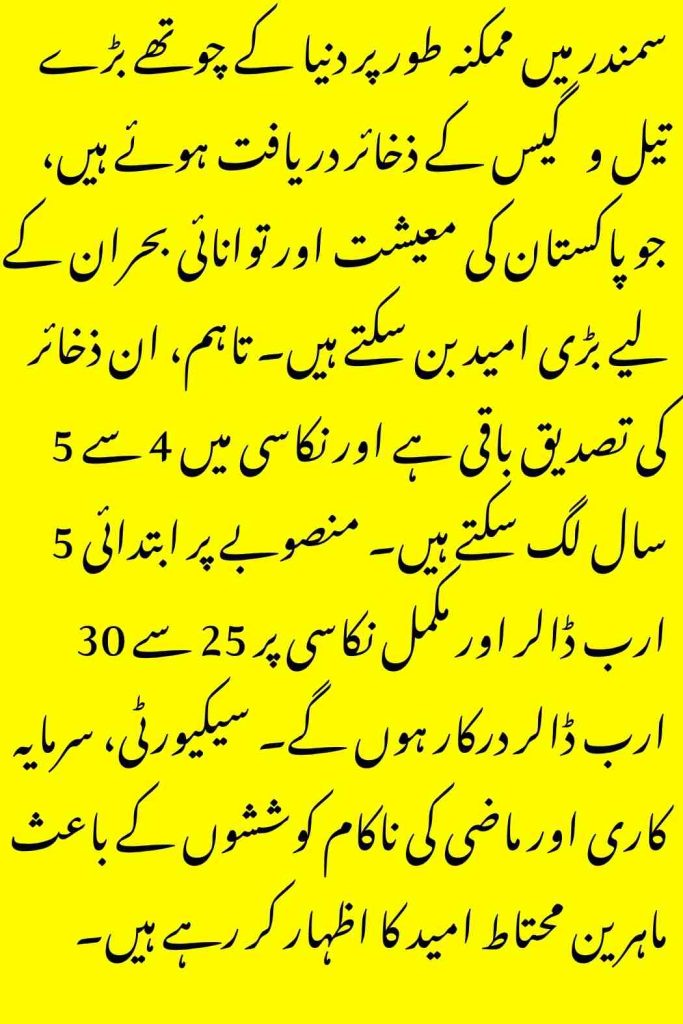

Pakistan has announced a significant discovery of oil and gas reserves in its territorial waters, potentially ranking among the world’s largest. The find, identified through a three-year survey conducted with an allied nation, has sparked cautious optimism about transforming the country’s economic and energy landscape. However, experts warn that extraction is years away and requires substantial investment. Below are the key details and implications of this breakthrough.

Oil and Gas Reserves: Key Details

| Aspect | Details |

|---|---|

| Location | Offshore, Arabian Sea (Indus and Makran Basins) |

| Estimated Rank | Potentially 4th largest globally (unconfirmed) |

| Survey Duration | 3 years, completed in 2024, with a friendly nation |

| Initial Investment Needed | ~$5 billion for exploration; $25–30 billion for 10% extraction over a decade |

| Extraction Timeline | 4–5 years for offshore extraction, pending drilling and infrastructure |

| Key Players | OGDCL, PPL, Mari Petroleum, SIFC; potential partnership with Turkey, China |

Current Status: Discovery Awaiting Confirmation

The discovery, first reported in September 2024, stems from a seismic survey in Pakistan’s maritime territory, pinpointing significant hydrocarbon deposits. While some estimates suggest these could be the world’s fourth-largest reserves, trailing Venezuela, Saudi Arabia, and Canada, experts like former Oil and Gas Regulatory Authority (OGRA) member Muhammad Arif emphasize that confirmation requires further exploration. The Oil and Gas Development Company Limited (OGDCL) clarified that the survey data is still being analyzed, and claims of a definitive find remain premature.

In February 2025, Pakistan opened 40 offshore and 31 onshore blocks for bidding, with Turkey signing an agreement to jointly explore 40 offshore blocks in the Makran and Indus Basins alongside Mari Energies, OGDC, and Pakistan Petroleum Limited (PPL).

Why This Discovery Matters

Pakistan’s energy sector faces severe strain, importing 85% of its oil, 29% of gas, and 50% of liquefied petroleum gas (LPG), with a 2023 energy import bill of $17.5 billion, projected to hit $31 billion by 2030. This discovery could:

- Reduce Import Dependency: Gas reserves could replace LNG imports, while oil could substitute imported crude, saving billions annually.

- Boost Economic Stability: Foreign exchange reserves, which hit a low of $2.9 billion in 2023 but reached $9.4 billion by June 2024, could strengthen significantly.

- Enhance Blue Water Economy: Beyond hydrocarbons, the survey highlights potential for minerals like cobalt and nickel, supporting marine biotechnology and ecotourism.

Challenges Ahead

Despite the excitement, several hurdles remain:

- High Costs: Exploration alone requires $5 billion, with full extraction needing $25–30 billion over a decade.

- Security Risks: Attacks on foreign workers, including a March 2024 suicide bombing killing five Chinese engineers, deter international oil majors like ExxonMobil and Eni, leaving China and Turkey as likely partners.

- Past Failures: A 2019 offshore drilling attempt at Kekra-1 by ExxonMobil and others, hyped as a major find, yielded no reserves after $100 million in costs, highlighting the risks of premature optimism.

- Extraction Timeline: Offshore drilling could take 4–5 years, delaying economic benefits.

Unique Insights

- Geopolitical Leverage: The discovery could shift regional dynamics, with Pakistan’s strategic location in the Indian Ocean attracting interest from China’s Belt and Road Initiative, potentially countering Western reluctance to invest.

- Local Resistance: In Balochistan, where onshore reserves are also significant, separatist groups have targeted energy projects, raising concerns about sabotage risks, per security analysts.

- Smuggling Complications: Iran’s $1 billion annual fuel smuggling into Pakistan could intensify if domestic production ramps up, complicating market dynamics.

- Environmental Concerns: Offshore drilling poses risks to marine ecosystems, with no public plans yet for environmental safeguards, potentially sparking protests from coastal communities.

What’s Next

- Exploration Bidding: Proposals for the 40 offshore blocks are under review, with Turkey and Pakistan’s state-owned firms leading efforts. China is in talks for involvement, given its risk tolerance.

- Government Action: Prime Minister Shehbaz Sharif has directed the Pakistan Navy to oversee maritime security for exploration, but no official statement confirms the reserves as Asia’s largest, debunking earlier claims.

- Public Sentiment: Posts on X reflect mixed feelings, with excitement about economic revival tempered by skepticism due to past unfulfilled promises, like the 2019 Chiniot gold reserves.

How to Stay Informed

- Official Updates: Monitor announcements from the Petroleum Division, OGDC, or SIFC for confirmed reserve estimates and bidding outcomes.

- Avoid Misinformation: Rely on verified sources, as exaggerated claims of “Asia’s largest reserves” have been dismissed by experts.

- Track Investments: Watch for developments involving Turkey’s TPAO or Chinese firms, as their involvement will signal progress.

Outlook

While the discovery offers hope for Pakistan’s cash-strapped economy, the road to extraction is long, costly, and uncertain. With proper management, transparency, and strategic partnerships, these reserves could reduce Pakistan’s $17.5 billion energy import burden and stabilize its economy. However, security challenges, high costs, and past disappointments urge cautious optimism. Stay tuned for updates as exploration progresses.

Disclaimer: Information is based on reports and official statements as of June 24, 2025. Reserve estimates and timelines are subject to change pending further exploration. Visit www.petroleum.gov.pk for updates.